With more than $12 billion in annual revenues, Keurig Dr Pepper Inc. (KDP) in Plano, Tex., is one of the largest beverage companies in North America. The company has a portfolio of more than 125 owned and licensed, and partner brands. Also, it markets the #1 single-serve coffee brewing system in the U.S. and Canada.

KDP pays a $0.75 dividend annually, yielding 2.03% at its current share price. Its four-year average dividend yield stands at 102.5%, which is 4191.1% higher than the industry average of 2.39%. KDP paid $0.1875 per share as a quarterly dividend on April 15.

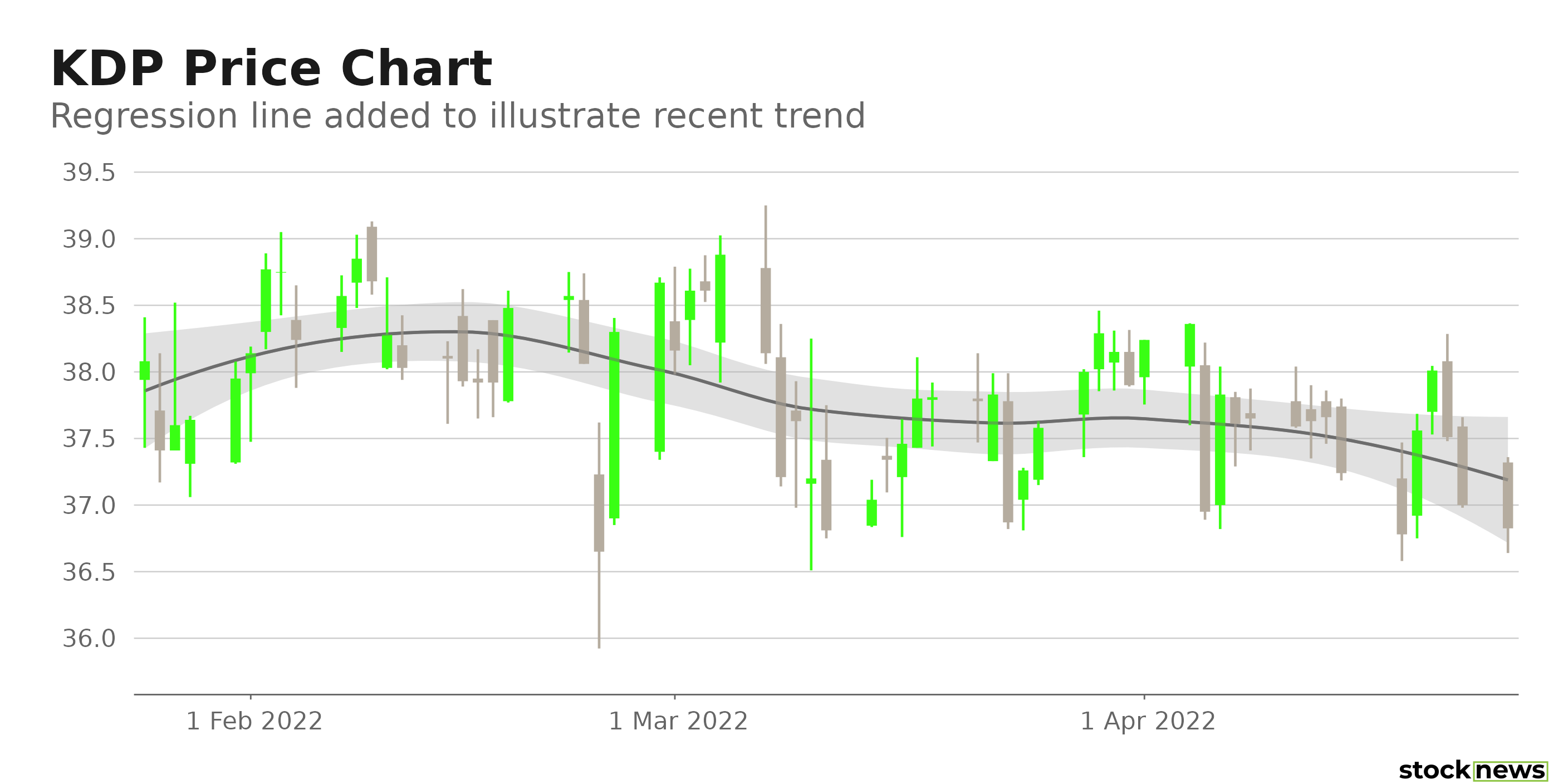

KDP’s shares have gained 6.4% in price over the past six months, thanks to investors’ rising interest in dividend stocks.

Here is what could shape KDP’s performance in the near term:

Strong Financials and Cash Flows

KDP successfully navigated through the pandemic headwinds and delivered impressive financials last year. Also, the company met its three-year merger commitments set during its merger in 2018, while its adjusted EPS rose in double digits percentage terms for the third consecutive year.

For its fiscal year 2021 (ended December 31), KDP’s net sales rose 9.2% year-over-year to $12.68 billion. The company grew its market share to nearly 75% of its cold beverage retail base and added almost three million new U.S. households to the Keurig system, driving its revenue growth. Its operating income came in at $2.89 billion, up 16.7% from the same period last year. Its net income and EPS rose 61.7% and 61.3%, respectively, from their year-ago values to $2.15 billion and $1.50.

Its net operating cash flow increased 17% year-over-year to $2.87 billion, while its free cash flow amounted to $2.57 billion. In comparison, its management leverage ratio fell from 3.6x in 2020 to 2.9x in 2021.

Strategic Refinancing

On April 7, KDP announced its strategic refinancing plans to strengthen its balance sheet and improve its liquidity. This follows its successful deleveraging efforts over the past three years, which reduced its debt substantially. The company plans to issue a public offering of senior notes in tandem with a series of tender offers to purchase specific outstanding senior secured notes. The company plans to issue tender offers for up to $4.85 billion worth of its outstanding senior unsecured notes.

On April 8, KDP announced the public offering of senior notes with multiple maturity periods. The company is slated to raise approximately $ $2.96 billion in net proceeds through this consolidated senior notes offering. It plans to use these funds, along with its outstanding cash balance, to repurchase certain outstanding senior unsecured notes.

If its tender offers and redemption plans are not completed, the company plans to use the net proceeds from the senior notes offering to meet its general corporate expenses, including working capital, acquisitions, debt retirement, and other business opportunities.

Consensus Rating and Price Target Indicate Potential Upside

Among the eight Wall Street analysts that rated KDP, four rated it Buy, while four rated it Hold. The 12-month median price target of $40.63 indicates a 9.8% potential upside from Friday’s closing price of $37.00. The price targets range from a low of $36.00 to a high of $44.00.

POWR Ratings Reflect Rosy Prospects

KDP has an overall B rating, which equates to Buy in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

KDP has a B grade for Stability, Sentiment, and Growth. The stock’s relatively low 0.60 beta justifies the Stability grade. In addition, analysts expect both its revenue and EPS to rise 5.5% year-over-year in fiscal 2022 (ending Dec. 31, 2022, in sync with the Sentiment grade. Also, the company’s revenue and EBITDA have risen at CAGRs of 19.5% and 28.4%, respectively, over the past three years, matching the Growth grade.

Among the 35 stocks in the B-rated Beverages industry, KDP is ranked #12.

Beyond what I have stated above, view KDP ratings for Momentum, Value, and Quality here.

Bottom Line

As one of the largest beverage companies operating in North America, KDP boasts strong cash flows and liquidity, allowing it to maintain its quarterly dividend payouts. Given the immense market volatility and concerns surrounding a potential recession, we think KDP is an ideal investment bet for fixed-income investors.

How Does Keurig Dr Pepper (KDP) Stack Up Against its Peers?

While KDP has a B rating in our proprietary rating system, one might want to consider looking at its industry peers, Coca-Cola Consolidated, Inc. (COKE), Compania Cervecerias Unidas, S.A. (CCU), and Kirin Holdings Company, Limited (KNBWY), which have an A (Strong Buy) rating.

KDP shares were trading at $36.78 per share on Monday morning, down $0.22 (-0.59%). Year-to-date, KDP has gained 0.79%, versus a -11.04% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities.

The post Keurig Dr Pepper: A Stable Dividend Stock You Can Count On appeared first on StockNews.com