The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities*

- Trend Model signal: Neutral*

- Trading model: Bullish*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

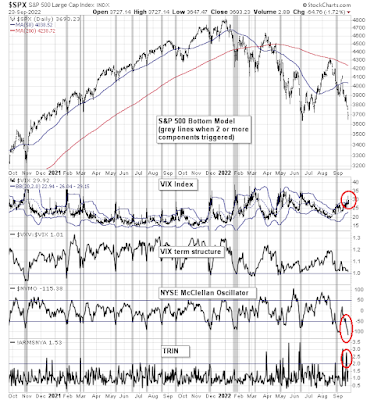

A crowded short In the wake of the post-FOMC meeting downdraft, three of the four components of my bottom spotting models flashed buy signals.

- The VIX Index has spiked above its upper Bollinger Band, which is an oversold condition for the market,

- Yhe NYSE McClellan Oscillator had become wildly oversold, and

- TRIN spiked above 2, indicating price insensitive panic selling.

Other sentiment models are also pointing to crowded short conditions. In many ways, traders had already thrown in the towel even before the FOMC meeting, which is likely to put a floor on stock prices. But there is a right way and a wrong way to throw in the towel.

The full post can be found here.